Uncovering Alternatives in the Bond Market

Across the Treasury yield curve, U.S. Treasury yields were significantly higher in 2022 with shorter maturity securities higher by 4%. Additionally, intermediate- and longer-term Treasury yields were higher by over 2%, taking the 10-year Treasury yield to the highest levels since 2007. After years of falling interest rates, 2022 was a year of steeply higher rates. So where do we think the yield on the 10-year Treasury security is headed in 2023?

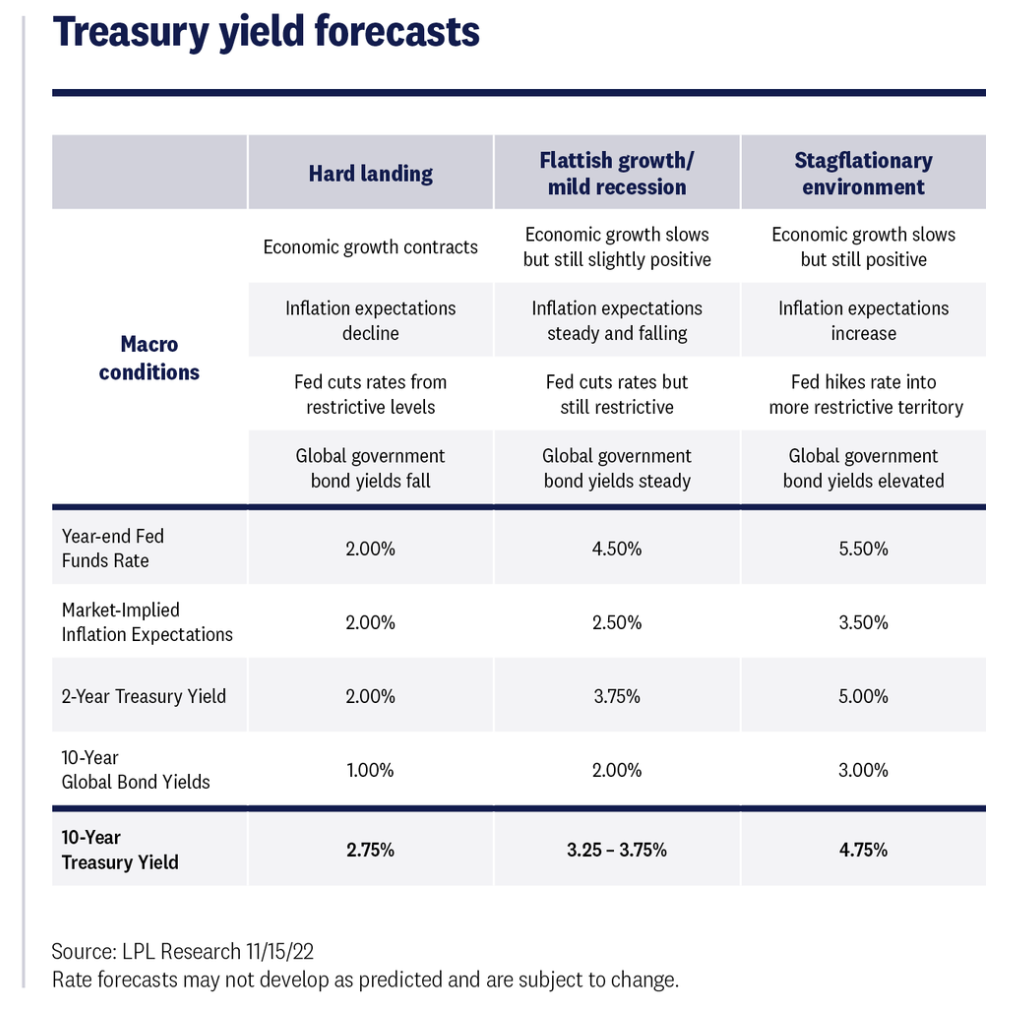

The path of interest rates will certainly be largely influenced by the Fed’s behavior, which will be guided by economic growth and inflation data. Equally important is the level of non-U.S. developed government bond yields, as foreign investors are an important buyer of U.S. Treasuries. Higher foreign market yields, all else equal, generally dissuade foreign investment into our markets. There are a range of scenarios we think could play out over the next year. However, given our view that the U.S. economy could eke out slightly positive economic growth next year, we think 10-year Treasury yields could end the year around 3.5%.

The road to recovery for core bonds

The core bond index (as defined by the Bloomberg Aggregate Bond Index) is seeing losses unlike any year since its inception. Core bonds are down nearly 16% in 2022 and have wiped out five years of index gains. But because bonds are both financial instruments and financial obligations, which pay coupons and principal repayments at par when they mature, the potential for recovery is a bit more certain than in the equity markets that rely primarily on price appreciation. So, how long will it take to recover this year’s losses?

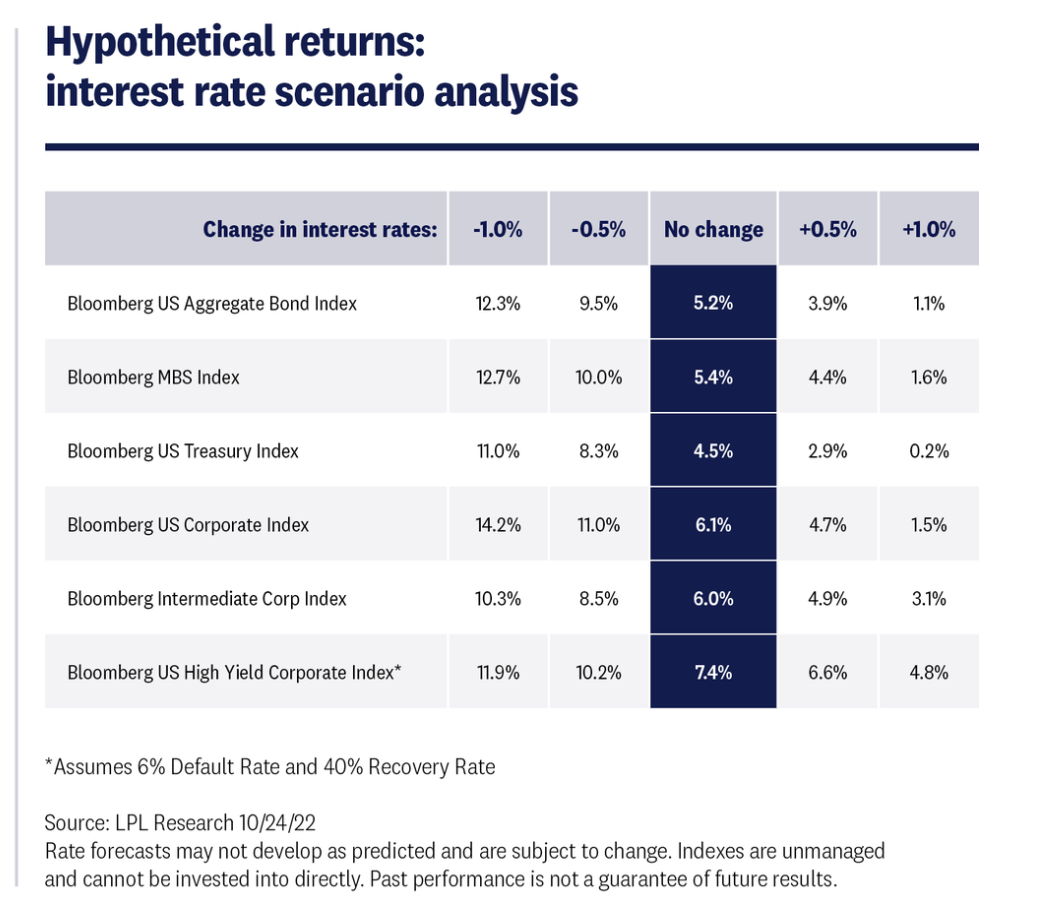

Here are some expectations for various fixed income markets under different interest rate scenarios. If interest rates don’t change at all, the best expectation for performance over the next year would be the index’s starting yield (dark blue highlighted section). Although, if interest rates decline by 0.5%, the Bloomberg Aggregate Bond Index could return more than 9% over the next 12 months. Moreover, if interest rates move back into the low 3% range, the core bond index could return around 12% over the next year. Also, and importantly, given where starting yields are, if interest rates increase by another 1% from current levels, fixed income markets broadly could still generate positive returns over the next 12 months. Given the move higher in yields we have experienced this year, we think the risk/reward for owning core bonds has improved.

However, for investors that don’t want to take on a lot of interest rate risk, the opportunity set in shorter maturity fixed income securities has improved as well. With 1- and 2-year Treasury securities both yielding above 4%, cash and cash-like instruments finally offer an attractive yield. Moreover, shorter maturity investment grade corporate securities are offering yields in line with longer maturity corporate credit securities—without the same level of interest rate or credit risk.

One thing to consider is that because starting yields are the best predictor of future returns over the maturity of a fixed income instrument, by taking on that additional interest rate risk and owning a full market core bond portfolio, investors would be “locking in” investments at higher yields for a longer period of time. If interest rates do fall from current levels, investors that are in shorter maturity securities would then have to reinvest proceeds at lower rate levels.

So for investors with an investment time horizon greater than five years, a full market core bond portfolio may make sense. Otherwise, shorter maturity securities offer attractive yields as well. Bottom line, after the back-up in yields in 2022, there are a number of attractive fixed income opportunities again.

What’s next for corporate credit?

Since Treasury yields are generally used as the base rate for consumer and corporate borrowers, this year’s increase in Treasury yields pushed many borrower’s borrowing costs to levels not seen in years. For corporate borrowers, after years of borrowing at ultra-low rates, the backup in yields we’ve seen this year has pushed corporate borrowing rates back above 6%, which is the highest levels since 2009. Could higher borrowing costs for corporates reduce profitability and potential growth opportunities?

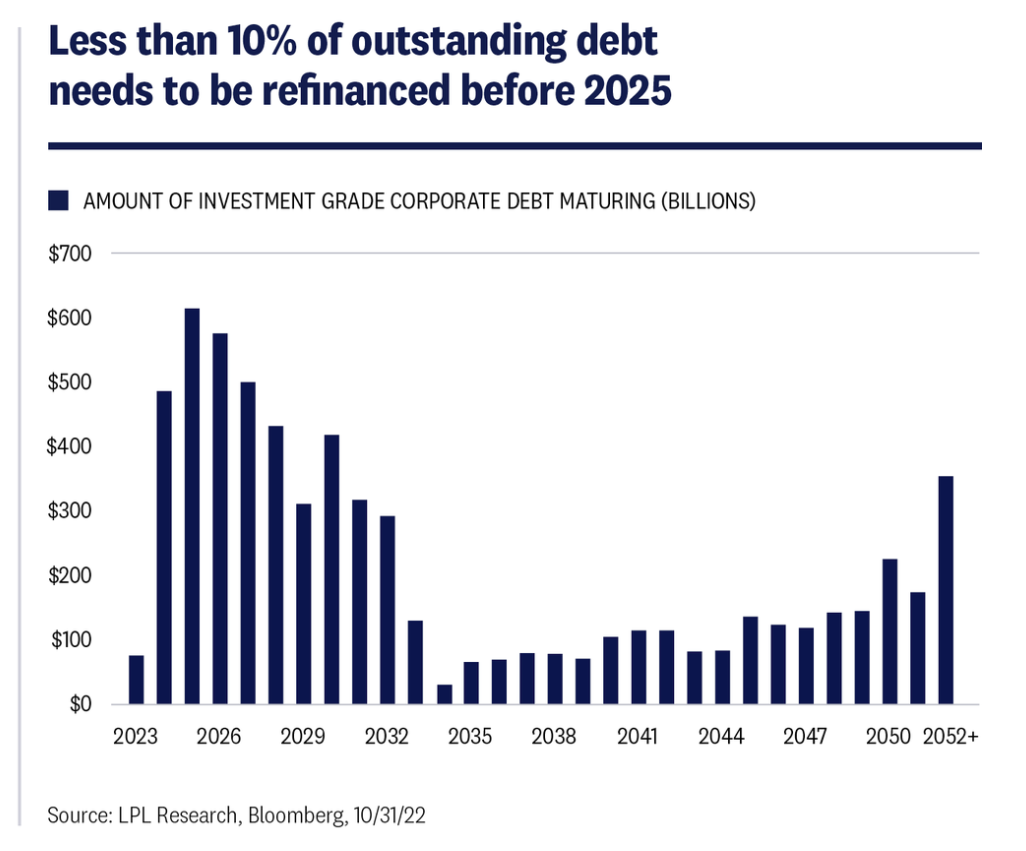

Perhaps, but over the last two years in particular, corporate borrowers have increased the amount of new debt issued seemingly to prepare for the rising rate environment we’re currently facing. In fact, new corporate debt issuance for investment grade companies hit record highs in 2020 and 2021 when over $3 trillion of new debt was issued. As such, corporate entities were able to term out debt by issuing a lot of debt at longer maturities and lower rates. Also, and notably, because companies were able to refinance existing debts over the last few years and push out maturities [Fig. 11], only about 1% of existing debt needs to be refinanced in 2023, and less than 10% needs to be refinanced before 2025. So the need for companies to refinance existing debt at these higher levels seems to be currently muted.

That said, if the Fed is able to keep rates at these elevated levels, and as the need for corporate borrowers to access the capital markets increases, there’s no doubt that corporate profitability will be negatively impacted by higher interest expenses. However, we don’t think it will happen in the near term.

Could History Drive Stocks in 2023?

Equity markets lacked balance in 2022 as the challenging macro environment overwhelmed business fundamentals. Stubbornly high inflation and sharply higher interest rates were the dominant market drivers, pressuring valuations and inciting fears of recession and falling corporate profits. In 2023, we look to equity markets to find balance between key macroeconomic factors—inflation, interest rates, and Fed policy—and business fundamentals.

Reaching the peak of the rate climb

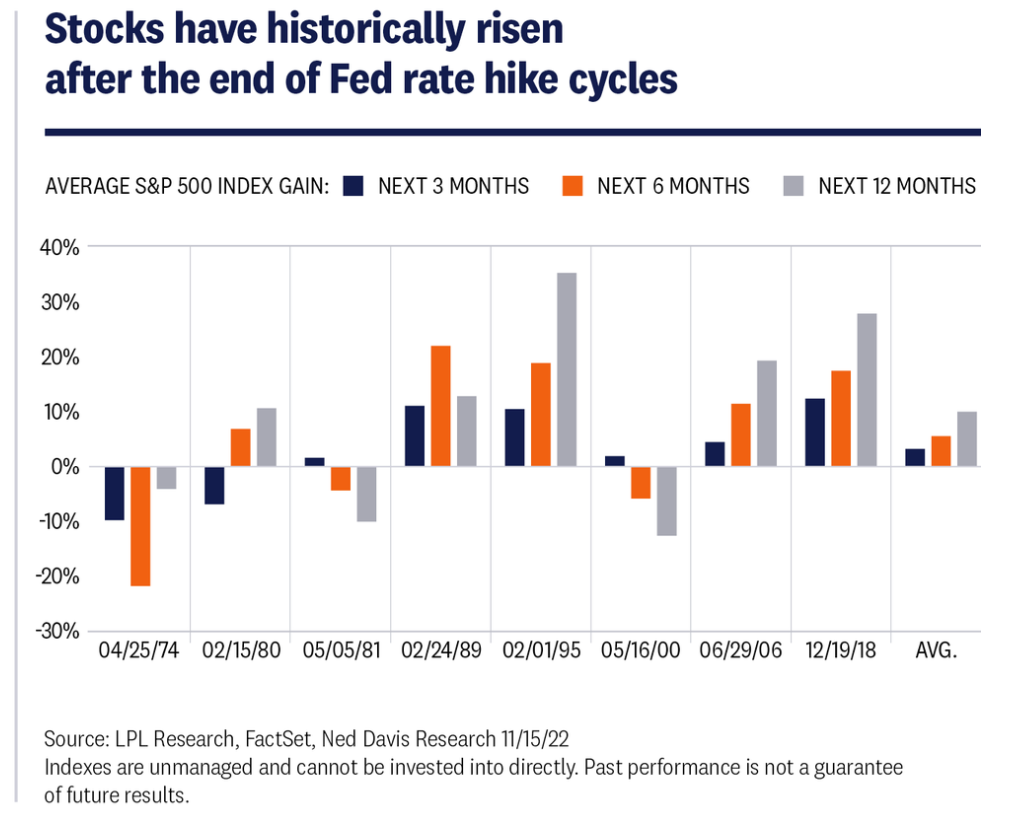

If stocks are going to go higher in 2023, a prompt end to the Fed’s rate hiking campaign will likely be a key component. The timing of the last rate hike of this cycle is uncertain and won’t be clear for a while, but our view is that the Fed will pause in early spring of 2023 amid an improving inflation outlook and loosening job market. Should that occur, stocks would likely move higher, consistent with history. Stocks have tended to produce solid gains after hiking cycles end, including a 10% average gain one year later.

Note that the two instances when stocks struggled the most after a Fed rate hiking cycle ended, 1981 and 2000, were both during recessions. A recession in 2023 may be more likely than not, but our expectation is that if a recession occurs, it will be more mild than those cases. Fourth quarter 1981 marked the start of the second leg of the double-dip recession after Fed Chair Paul Volcker famously broke the back of inflation with significant interest rate hikes, while 2000 was the start of the burst of the tech bubble that contributed to the recession in 2001.

What goes down tends to go up

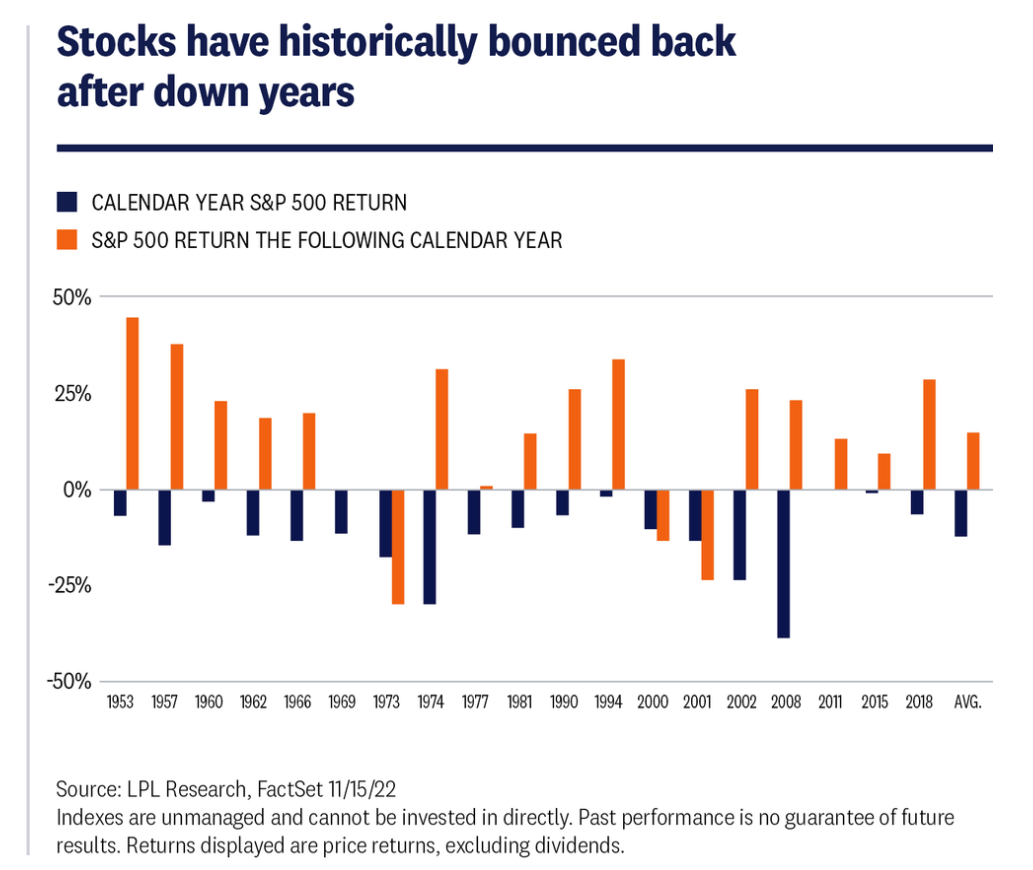

They say that what goes up must come down. For the stock market, it also works the other way. Through many economic downturns, recessions, and geopolitical crises over many decades, the stock market has always recovered. Those patient and courageous investors who were able to take advantage of those declines have usually been rewarded nicely. Following down years, the S&P 500 has risen an average of 15% with positive returns in 15 out of 18 years. Since 1950, a down year was only followed by another down year three times: in 1973, 2000, and 2001

Looking at this another way, after losing 20% or more at any point in time, the S&P 500 Index has gained an average of 17.6% over the subsequent 12 months (monthly data). The positive post-midterm election year pattern, discussed later in this publication, provides another historical analog that should be supportive of higher stock prices in 2023.

Wide range of possible earnings outcomes

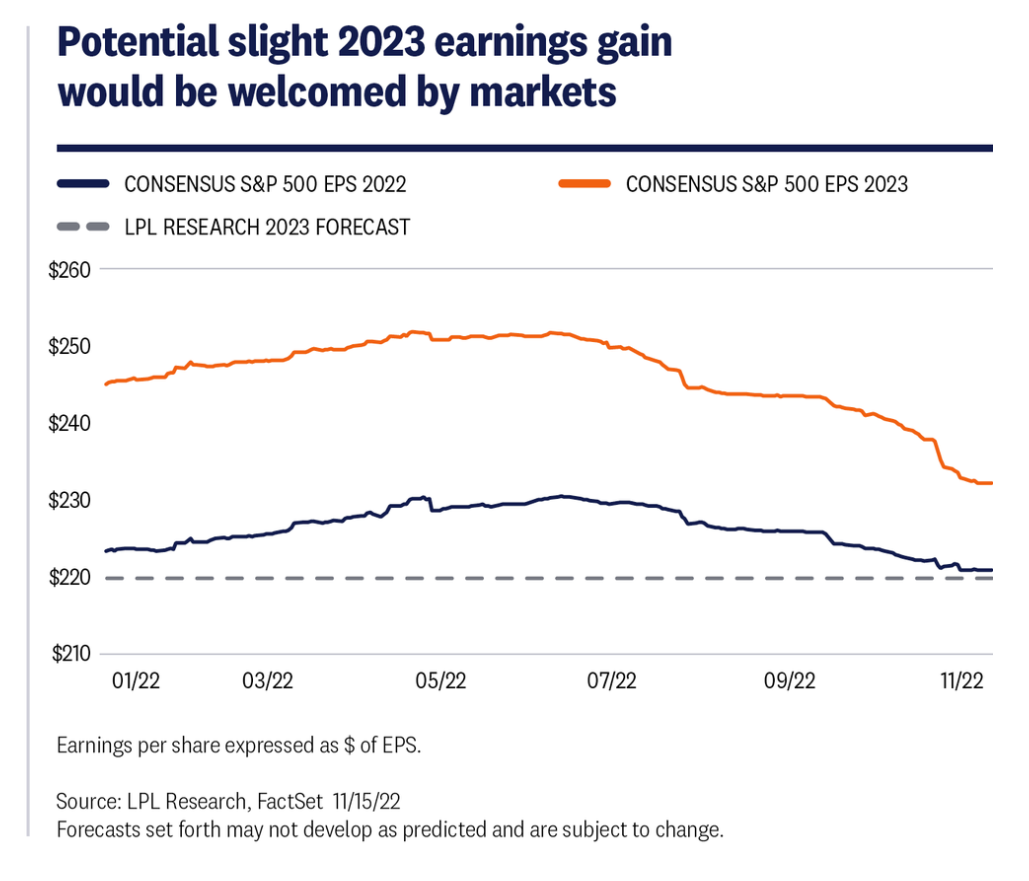

Corporate America faces significant headwinds as 2023 gets underway. Cost pressures amid high inflation and still-snarled global supply chains are the biggest factors, but slowing economic growth and the strong U.S. dollar may make any earnings growth in 2023 difficult to achieve. Many companies over-earned during the pandemic, so some reversion back to normal still needs to occur. Inventories also need to be brought down. Even though some of these pressures have started to ease, lower commodity prices and slightly looser labor markets have, thus far, had limited impact on inflation overall. Our base case for S&P 500 earnings per share in 2023 is $220, similar to where 2022 is tracking and about $12, or 5%, below the consensus estimate as of November 15, 2022. Revenue will continue to get a boost from inflation, as many blue chip companies during third quarter earnings season have demonstrated an ability to pass along higher prices due to their pricing power. But margins will likely compress further over the next several quarters before support from lower costs potentially arrives.

An upside scenario could materialize if inflation falls faster than we anticipate, propping up margins and potentially putting S&P 500 earnings per share as high as $235 in 2023 and over $250 in 2024. On the other hand, stubbornly high inflation and a more prolonged economic downturn could introduce downside risk, possibly down to $200 per share in earnings in 2023 before a potential rebound to $230 in 2024.

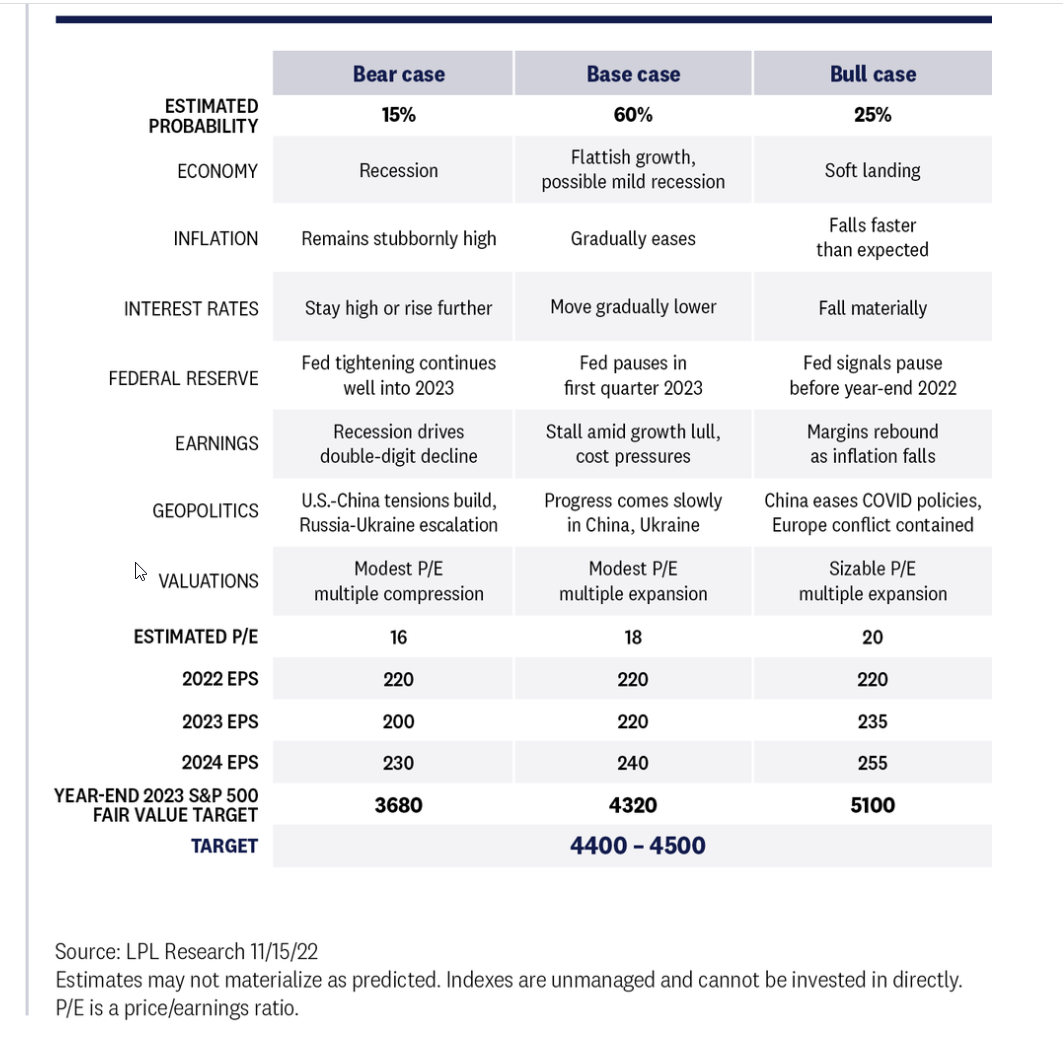

Tilting the scales back in favor

In 2022, the bear market decline in stocks was all about the macro picture—high inflation, surging interest rates, and rising recession risks. Strong consumer and corporate balance sheets and growth in corporate profits were not rewarded by investors, who were focused on rising recession risk and concerns of higher interest rate levels affecting future earnings. Add to that a tense geopolitical landscape and a strong U.S. dollar, and stocks struggled to make any headway throughout the year. Looking ahead to 2023, stock drivers are likely to be more balanced. Rather than the scales tilting toward rising interest rates and runaway inflation, we may see falling interest rates and lower inflation supporting higher stock valuations. Should the outlooks for economic growth and inflation improve as 2023 progresses, stocks may also get a lift from prospects for stronger earnings growth in 2024. LPL Research’s Strategic and Tactical Asset Allocation Committee (STAAC) sees fair value for the S&P 500 at 4,400–4,500 at year-end 2023, based on a price-to-earnings ratio of 18–19 and $240 per share in S&P 500 earnings in 2024. That target is also derived from probability-weighted scenarios and based on various paths for the economy, inflation, interest rates, and earnings.

Our bear case fair value of 3,680 is based on 16 times $230 per share in S&P 500 earnings in 2024, while our bull case of 5,100, which we see as slightly more likely than the bear case, is based on 20 times $255 per share in S&P 500 earnings in 2024. We look for stocks to find better balance between the macro environment and business fundamentals in 2023, tilting the scales toward the bulls.

Optimistic about technical trend reversal

It has been mostly downhill for the S&P 500 since kicking off the year with a record-high. The downtrend since January severely damaged market breadth and momentum. More recently, oversold conditions coupled with seasonal tailwinds underpinned a relief rally off the October lows. While some technical damage has been repaired, the S&P 500 remains in a downtrend and below its declining 200-day moving average (DMA). We are optimistic for a trend reversal in 2023 and suspect it will be accompanied by a pullback and/or consolidation phase for Treasury yields and the US Dollar Index. In terms of upside for next year, a confirmed reversal on the S&P 500 should open the door for a retest of the August highs near 4,300. Probabilities for a breakout beyond this level would meaningfully increase if Treasury yields and the dollar continue to decline. History is also on the market’s side as the S&P 500 historically spends less than 30% of all trading days below its 200-DMA (since 1950). During this timeframe, whenever the index held below the 200-DMA for a six-month period, forward 12-month average and median returns were 14.2% and 18.3%, respectively.

What’s Next for the Economy in 2023?

The global economy will likely slow from the upper-2% range in 2022 down to the mid-1% range in 2023. Much depends on China’s growth path. An important aspect for investors is that the U.S. appears to have fewer headwinds to growth compared with Europe and other developed economies. The divergence between the domestic and international economies is most obvious in the inflation regime. Germany, for example, is still experiencing accelerating rates of inflation, whereas the U.S. has likely moved past the peak. The longer inflation is uncontained, the riskier the growth prospects.

If the U.S. falls into a recession, the chances are that it would occur during the first half of 2023 and will likely not be as deep as the 2008 recession, which was initiated by a fundamentally flawed financial market.

More clarity on potential for U.S. recession

There are three factors for defining a recession: depth, diffusion, and duration—conveniently referred to as the “three Ds.” Depth refers to declining economic activity that is greater than any relatively small change. Diffusion describes an economy that has experienced a contraction in a wide range of sectors, such as trade, business activity, and consumer spending. Duration, likely the least important of the three Ds, measures the time between the previous business cycle peak and the following trough. Since World War II, the average recession has lasted just over 10 months (down from an average of 17 months if you date back to 1854), according to the National Bureau of Economic Research. Given the unique cause of the 2020 recession, the time between peak and trough was the shortest on record—only two months.

One reason we’re currently seeing a healthy debate on the likelihood of a recession is that for most of 2022, not all of the metrics were flashing warning signs. However, recent data may give us more clarity. The Conference Board’s Leading Economic Index (LEI) has declined for seven of the last nine months, showing that the economy could enter a period of significant and broad-based contraction. The decline is predictable as many sectors, such as housing, started slowing months ago. Since the inception of the index, a decline of this magnitude over a six-month period has always foreshadowed a recession in subsequent quarters. As such, we think recession risks appear more probable by the beginning of 2023. If the economy does fall into a recession, the cause will likely be from the consumer sector retrenching after years of inflationary pressures, high housing costs, and slow real wage growth.

Even though investors are tempted to say “this time is different,” we all can take note of general principles about business cycles and the markets. The Fed has warned that the current inflation fight will be painful, so a dip into a recession should not be that surprising.

Readjustments in the job market could lessen pain

The Fed has repeatedly warned investors about the potential for pain from the fight with inflation. That pain is mostly likely associated with an expected increase in unemployment as the job market cools from a slowing economy. The Job Openings and Labor Turnover report was hardly on center stage, until Fed Chair Jerome Powell used a press conference to highlight the number of job openings in the economy. The pandemic caused these three metrics to become off balance: the ratio of openings to unemployed, the number of those not in the labor force, and the percent of firms having difficulty finding qualified workers. Investors should watch these metrics throughout 2023 as the economy leads to a more balanced labor market.

We expect the ratio of openings to unemployed to fall as the economy slows and firms cut their number of job openings. Firms often quickly respond to a slowing economy: during the 2008 financial crisis, the number of openings fell by 50% in roughly 16 months, so this metric could revert quickly. The persistent problem of individuals out of the labor force has kept the labor market tight, but a potential improvement in labor force participation in the prime age population (25–54 year olds) with improved productivity would be a powerful remedy. And in terms of firms’ struggle to find qualified workers, the coming year will reveal how firms are responding to current labor market conditions and any potential impact this may have on businesses. If the labor force grows back to its pre-pandemic trend, many of these near-term conditions would improve.

Housing market should begin to normalize

The housing market is still normalizing in response to an economy under pressure from higher borrowing costs, nagging inflation, and uncertainty about future Fed activity. Slowing residential investment will create a drag on economic growth at the start of 2023, but demographics of Millennials and Generation Z could provide some support for housing demand later in the year. Nevertheless, in the near term, housing demand will likely fall further in the coming months, putting downward pressure on median prices. Housing plays a significant role in consumer spending and investors should monitor the housing market as a bellwether for the health of the consumer. Consumers spend roughly 34% of their total spending on housing, so a decline in housing-related costs should give consumers more for discretionary spending.

The hybrid work environment and the corresponding interest to move to areas with lower cost of living created an imbalance in the housing market, especially during the trough in mortgage rates. Regional variations will likely remain as geographic reshuffling continues. In 2023, the potential for more multi-family dwellings should help bring the demand and supply for rentals into balance, while more rentals and normalizing house prices should ease inflation.

Inflation should become convincingly softer

Investors and central bankers will likely enter 2023 with a slightly different trajectory for inflation, particularly services inflation. In recent months, durable goods prices have clearly decelerated—and in some cases, outright declined—but services prices have been stubbornly accelerating as rent prices and health services rose. We could potentially be entering a new regime as rents across the country are showing signs of abating. During this transition period for services prices, the coming year could be the time when inflation is convincingly decelerating closer to the Fed’s long-run target of 2%. If inflation in 2022 was about supply constraints, then inflation in 2023 could center on demand constraints. For the past year, supply-related problems contributed more to inflation than demand-related imbalances. China’s zero-COVID-19 policy was one of the biggest glitches in supply chains as metro areas and ports were shuttered by the Chinese government.

However, things may be on the verge of changing as supply and demand get into balance throughout 2023, and as inflation likely becomes more demand driven and less supply driven. This is positive for policymakers because monetary policy tools do not work on supply shocks but rather, only on demand; thus, these tools are now more relevant than they were when inflation was primarily from supply bottlenecks. So as supply constraints ease and as Fed tools become more impactful, we could see the rate of inflation decelerating further in 2023.

Through all the challenges, newfound opportunities, and every high and low we’ve experienced during the last couple of years, it’s no surprise why we might be striving for more balance. Whether it’s about the markets and global economy or what’s happening in our local communities, the news we’re hearing on a daily basis has the potential to disrupt the balance of our lives. But with resilience, perspective, and the support of close connections, we can navigate through it all and regain our sense of equilibrium—even after another dizzying year, as 2022 proved to be.

After two years of disruption due to the COVID-19 pandemic, we were searching for some kind of return to normalcy, while at the same time, still experiencing the aftereffects of the pandemic. Some of those aftereffects included the imbalances created by the fiscal, monetary, and public health policy put in place to address the pandemic— and the process of addressing those imbalances has been disorienting at times. If 2022 was about recognizing imbalances that had built in the economy and starting to address them, we believe 2023 will be about setting ourselves up for what comes next as the economy and markets find their way back to steadier ground—even if the adjustment period continues.

The Federal Reserve (Fed) spent 2022 aggressively fighting inflation by raising interest rates. In 2023, we expect the Fed to find that point where it can stop raising rates, as inflation starts to come under control. The Fed’s efforts to control inflation throughout 2022 pulled interest rates off of extremely low levels that were historically unprecedented. While that has been painful for bond investors, for the first time in a decade, savers can now get an attractive yield, and 2023 will be more focused on how to potentially benefit from this significant shift. Stock market expectations may also see some realignment heading into 2023. The projections for certain market segments became too high in 2022 following a decade of low rates and a burst of extraordinary technology adoption. We expect 2023 will likely be more focused on the opportunities that may emerge from a market sell-off.

Over the next few weeks, we are going to take a look at how the readjustments in the economy and markets may impact you in the coming year. We will discuss topics such as stocks, bonds, economics and geopolitical factors. You can preview our full outlook here.

The disruptions may not be fully resolved and there may be more challenges to come, but progress toward finding balance is well underway. And when those disruptions hit the market, it can be hard to find our footing and stay the course.

Those are the times when sound financial advice is more valuable than ever, as it helps us find our center, remember our plan, and stay focused on our goals.